Running a competitor analysis is really about getting under the skin of your rivals. You're systematically digging into their strengths, weaknesses, and overall game plan. It's not just a box-ticking exercise; it's about gathering real-world intelligence on their products, marketing efforts, and sales tactics to spot openings for your own business.

Think of it as an ongoing mission, not a one-and-done report. To stay sharp, you need to keep your finger on the pulse of what everyone else is doing.

Laying the Groundwork for Your Analysis

Before you even think about firing up Ahrefs or drowning in spreadsheets, you need to figure out why you're doing this. What's the point? Without a clear goal, you’ll end up with a mountain of useless data and a bad case of "analysis paralysis," where you're so overwhelmed you do nothing at all.

This first phase is all about creating a blueprint for your investigation.

Your main job here is to define what a "win" looks like for this project. Are you trying to find gaps in a competitor's content that you can exploit? Maybe you need to benchmark your pricing against the market leader to see if you're in the right ballpark. Or perhaps you're just trying to figure out what makes a rival's customer experience so special. Nailing down your objective from the start keeps the whole process laser-focused.

Getting a Handle on Who You're Up Against

A classic rookie mistake is only looking at the competitors staring you right in the face. A genuinely useful analysis means sorting your rivals into different buckets, because each type comes with its own set of challenges and opportunities.

It's helpful to break them down into categories to get a full picture of the competitive landscape.

Defining Your Competitor Categories

This table breaks down the different competitor types to help you accurately map out your competitive landscape.

| Competitor Type | Definition | UK Example (Meal Delivery) |

|---|---|---|

| Direct | Businesses offering a very similar product or service to the same target audience. | Another company that delivers pre-made, ready-to-eat meals, like Gousto. |

| Indirect | Businesses solving the same core problem but with a different solution or product. | A recipe box company like HelloFresh or a supermarket selling premium ready meals. |

Sorting your competitors this way is crucial. It forces you to look beyond the obvious and see the market as your customers do. You're not just fighting for a direct sale; you're competing for a share of their wallet and their attention.

This wider perspective is vital, especially when you consider how much pressure UK businesses are under. The Office for National Statistics found that heading into March 2025, 8% of businesses cited competition with other UK companies as a primary worry. In certain industries, like education, that number shot up to 23%. You can read the full ONS report on the business impact of competition to see the data for yourself. It really drives home why a thorough analysis is non-negotiable.

Defining Your Scope

Right, so you know who you're looking at. Now you need to decide what you're going to analyse. Trying to track every single move every competitor makes is a surefire way to burn out. You need a focused scope.

To keep things systematic and impactful, it’s a smart move to use a competitive analysis framework. A structured approach like this helps you zero in on the metrics that actually matter, stopping you from getting lost down a rabbit hole of irrelevant details. It's all about turning your findings into a clear, strategic advantage.

Finding the Competitors That Truly Matter

Your biggest rival might not be the brand you think it is. We often get caught up in the big, obvious names in our industry, but in the online world, the real fight is often against companies you've barely noticed. These are the ones quietly winning over your customers in search results and social feeds.

The goal isn't just to make a list of companies that sell similar stuff. It's about finding out who you’re actually competing against for attention online.

The best place to start? The search engine results page (SERP). Your true digital competitors are the websites ranking for the keywords your customers are typing into Google. Sometimes these aren't direct business rivals at all—they could be influential bloggers, review sites, or even companies solving the same core problem in a completely different way.

Uncovering Your Digital Rivals

This is where you need to let data do the talking. SEO platforms like Ahrefs or Semrush are brilliant for this. Just plug in your main keywords, and you’ll instantly see which domains are showing up most often. It takes the guesswork out of the equation and shows you exactly who has Google’s favour for the terms that drive your business.

For instance, the "Competing domains" report in Ahrefs is a goldmine for this kind of work.

This report gives you a clear visual of the keyword overlap between your site and everyone else's. A high percentage of overlap? That’s a direct digital competitor you need to be watching closely.

But search data, as powerful as it is, only paints part of the picture. To get the full story, you need to look beyond SEO metrics.

Expanding Your Search Beyond SEO

Relying solely on SEO tools can give you tunnel vision. To build a truly robust strategy, you need to understand the wider market conversation and customer sentiment. A multi-pronged approach is the only way to avoid developing dangerous strategic blind spots.

To get a more well-rounded view, try these methods:

- Social Listening: Keep an eye on conversations happening on X (formerly Twitter), LinkedIn, and industry-specific forums like Reddit. Which brands are people mentioning when they talk about the problems you solve? Tools like Brandwatch can help automate this, but even a manual search can reveal a lot.

- Industry Reports: Dive into market research from firms like Mintel or Statista. They often break down key players, market share, and emerging trends within the UK, pointing you towards established leaders and fast-moving disruptors you might not have known about.

- Customer Feedback: This one is pure gold. Go through your own customer support tickets, sales notes, and feedback forms. Which competitors do your prospects mention when they're comparing prices or features? This is direct intelligence coming straight from the source.

My Advice: Don't try to analyse everyone. The aim isn't to build an encyclopaedic list of every company in your space. Instead, focus on a tight, manageable roster of 3-5 key competitors. This should be a mix of direct, indirect, and even aspirational brands. This focus prevents you from getting stuck in "analysis paralysis" and ensures your hard work actually leads to smart, actionable decisions.

Selecting Metrics That Reveal Strategic Insights

Once you’ve got a list of your key competitors, the real work begins. The next challenge is figuring out what to actually look at. It’s easy to get bogged down in data, creating massive spreadsheets that offer plenty of numbers but zero clarity. The whole point of competitor analysis is to pick metrics that tell a story—a story about their strategy, their performance, and most importantly, where you can find an edge.

To avoid getting lost in the weeds, I always recommend breaking your analysis down into specific business areas. This gives you a consistent framework to compare your rivals directly, helping you turn raw data into something genuinely useful. Without that structure, you’re just comparing apples to oranges and you'll miss the patterns that matter.

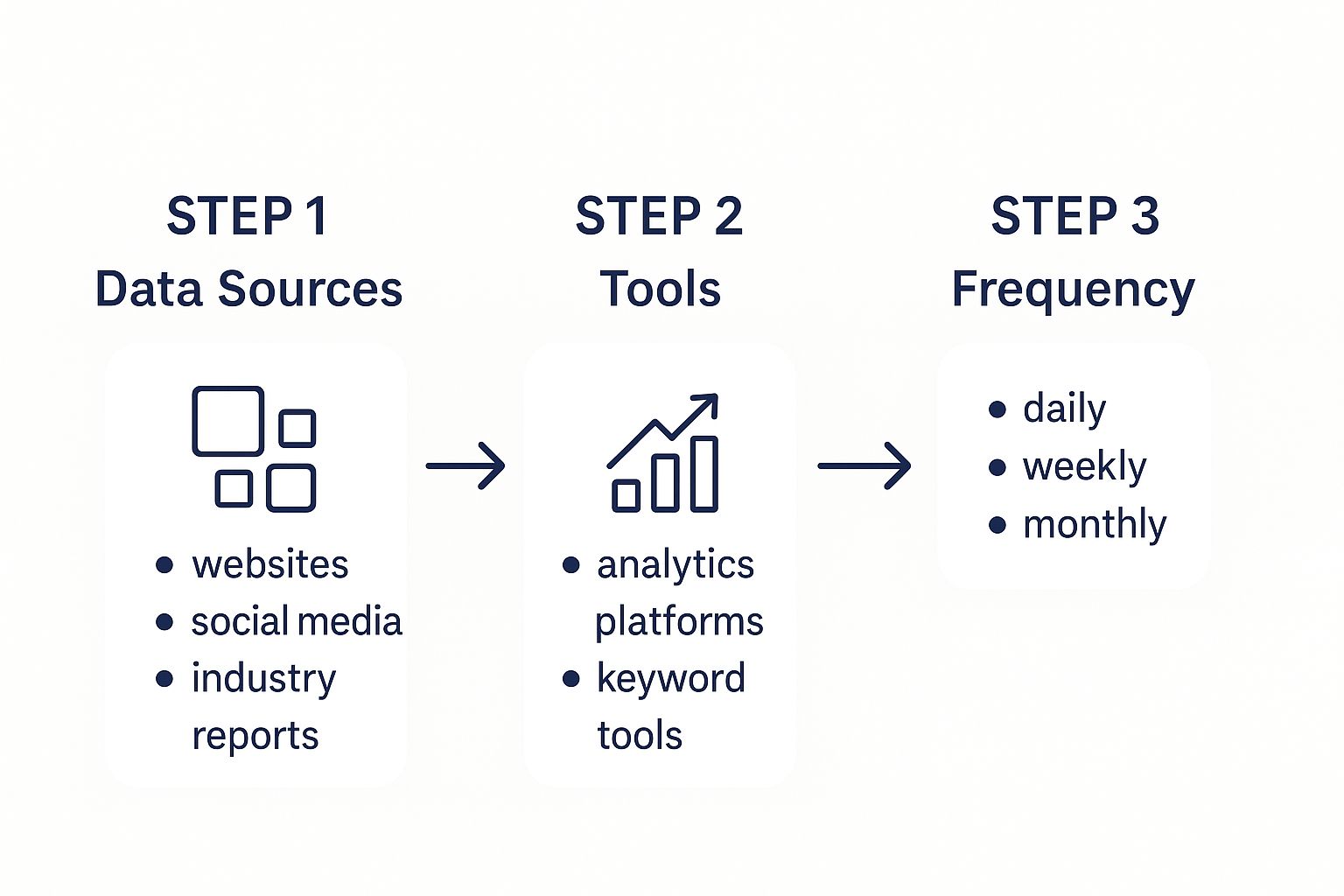

This simple workflow shows how to organise your data gathering, from pinpointing sources to choosing the right tools and deciding how often to check in.

Think of this as your roadmap. It turns random data collection into a systematic intelligence operation, making sure your efforts are efficient and repeatable.

To get you started, here’s a quick-glance table covering the essential metrics you should be tracking. It breaks down what to look for, why it matters, and some great tools to get the job done.

Essential Competitor Analysis Metrics

| Analysis Area | Key Metric | What This Tells You | Recommended Tool |

|---|---|---|---|

| SEO & Content | Keyword Gaps | Reveals valuable keywords your competitors rank for, but you don't. A direct path to new traffic opportunities. | Ahrefs |

| SEO & Content | Backlink Profile | Shows who is endorsing them. High-quality links indicate authority and successful digital PR efforts. | Semrush |

| Product & Pricing | Feature Comparison | Highlights their Unique Selling Propositions (USPs) and where your product might have an advantage or a gap. | Manual research, review sites |

| Product & Pricing | Pricing Tiers | Uncovers their target customer and perceived value. Are they a budget option or a premium service? | Competitor websites |

| Marketing | Social Media Engagement | Identifies which topics and formats resonate with your shared audience, guiding your own content strategy. | BuzzSumo |

| Marketing | Ad Spend & Channels | Shows where they're investing their marketing budget and what they believe drives conversions for their business. | Similarweb |

This table isn't exhaustive, of course, but it’s a solid foundation. It ensures you're looking at the business from all angles—not just focusing on one area and missing the bigger picture.

SEO and Content Performance Metrics

A competitor's digital footprint is often the easiest place to start because so much of it is public. Their SEO and content strategy is a dead giveaway for who they’re trying to reach and how they’re doing it.

I always begin by digging into their keyword profile. What terms are they ranking for that you aren’t? A significant keyword gap can uncover an entire market segment you’ve completely overlooked. Just as crucial is their backlink profile. Who’s linking to them? A long list of high-authority links points to a brand with real credibility and a strong digital PR game.

If you really want to go deep on this, have a look at our guide on mastering SEO analytics.

Here’s a pro tip: Don't just look at the volume of traffic; investigate its quality. Are they ranking for high-intent keywords that lead to sales, or just informational terms that drive vanity metrics? The real strategic insight lies in making that distinction.

Product and Pricing Strategy

It sounds obvious, but you need to understand what your competitors are actually selling. This goes way beyond just listing their products; it’s about dissecting their value proposition and pricing.

Here are a few things to zero in on:

- Core Product Features: What are their unique selling points (USPs)? Are they trying to win with cutting-edge innovation, superior quality, or just pure simplicity?

- Pricing Model: Do they use subscriptions, one-off payments, or a tiered structure? This tells you a lot about their ideal customer and how they position value.

- Customer Reviews: Get onto sites like Trustpilot and read what people are saying. What are the common complaints or praises? This is raw, unfiltered feedback on their real-world strengths and weaknesses.

When you’re benchmarking, context is everything. In the UK market, for example, the scale of businesses can be staggering. As of 2025, AstraZeneca’s market capitalisation was around £186.59 billion, which is roughly 10% more than the next-largest company, Linde. You’re not going to compete with that kind of giant in the same way you’d take on a small start-up, so keeping that economic backdrop in mind is crucial.

Marketing and Social Media Engagement

Finally, take a look at how your rivals talk to their audience. Their marketing channels and social media presence are a window into their brand personality and customer engagement strategy.

Check out their most engaging content on platforms like LinkedIn or Instagram. What’s getting all the likes and shares? That’s a direct clue as to what resonates with the audience you both share. It’s also smart to monitor their advertising campaigns. What messages are they pushing, and where? This shows you where they’re putting their money and what they think actually drives sales.

Building Your Competitor Intelligence Toolkit

Alright, you've got your list of key competitors. Now it’s time to pick your weapons. Building a solid competitor intelligence toolkit isn't about throwing money at every flashy platform; it's about being smart and blending powerful software with freely available resources.

The goal here is to create a system that's efficient and scalable. Without a structured approach, you'll drown in a chaotic mess of spreadsheets and random notes, and all those valuable insights will get lost. What we want is a clean, usable database that makes it easy to see what’s going on.

Curating Your Core Set of Tools

A good toolkit is a mix of different instruments for different jobs. You'll need some for the big-picture market view and others for digging into the nitty-gritty details, like keyword performance.

A great place to start is with a platform that gives you a comprehensive overview of a competitor’s digital footprint. Take Similarweb, for example. It provides a fantastic high-level snapshot of a rival's website traffic, where their audience comes from, and which marketing channels are doing the heavy lifting for them.

This kind of overview is perfect for quickly sizing up a competitor's market share and primary traffic sources. It helps you decide where to focus your energy for a deeper dive.

Beyond these all-in-one platforms, you'll need more specialised tools. Many businesses are also leaning on AI for more advanced insights. You can even check out some of the 5 best AI tools to help businesses with SEO here: https://amaxmarketing.co.uk/5-best-ai-tools-to-help-businesses-with-seo/ to see how automation is shaking things up.

Here are a few essential categories your toolkit should cover:

- SEO & Keyword Tools: You can't go without platforms like Semrush or Ahrefs. They're indispensable for picking apart organic search performance, backlink profiles, and finding those juicy keyword gaps.

- Social Listening Software: Tools such as Brandwatch are brilliant for keeping an ear to the ground. They let you track conversations about your competitors across social media, giving you a real sense of customer sentiment and brand perception.

- Free Alert Systems: Never underestimate the power of Google Alerts. Seriously. Set them up for your competitors' brand names, key products, and even their executives. You'll get real-time updates on news and mentions delivered right to your inbox.

A Quick Word on Ethics: It should go without saying, but always gather your intelligence ethically. Stick to publicly available information and never cross any legal or moral lines. That means no trying to access private systems or using dodgy practices to get information. Keep it professional.

Organising Your Intelligence Gathering

Tools are great, but they're useless without a system for organising the data you collect. This is where a central template or dashboard becomes your best friend. A well-designed spreadsheet or database ensures everything is consistent, making it a breeze to compare competitors side-by-side.

It’s interesting to note that while everyone talks about competitor analysis, its formal adoption is still patchy. A recent report found that only 22% of UK businesses formally bake competitor SEO analysis into their strategies. This gap is a massive opportunity for you to get ahead simply by being more systematic than the competition.

To keep a constant eye on what your rivals are up to, think about using tools specifically for monitoring website changes to track competitors. This proactive approach means you’ll never miss a critical update, like a price drop, a major site redesign, or a new product launch.

Turning Raw Data Into Winning Strategies

Gathering all that competitor data is a great start, but it's what you do with it that really counts. Let's be honest, a spreadsheet full of metrics is useless until you turn it into a concrete plan. This is where you connect the dots and move from simply observing your rivals to actively outmanoeuvring them.

The goal here isn't just to collect facts; it's to find those golden nuggets of insight that will sharpen your marketing, improve your product, and ultimately, bring more customers through the door.

Frame Your Findings with a SWOT Analysis

I've always found that a classic SWOT analysis is the perfect tool for this job. It’s a straightforward but incredibly effective way to organise your thoughts and see the big picture. Instead of just looking at your own business in a vacuum, you'll apply it to the competitive landscape you've just mapped out.

Here’s how to put it into practice with your competitor data:

- Strengths: Where do you have the upper hand? Maybe your site's page speed is miles ahead of everyone else's, or your customer reviews consistently rave about your support team. These are your current advantages.

- Weaknesses: Where are you falling behind? Be brutally honest. It might be that significant keyword gap you uncovered, a missing pricing tier, or the fact your social media engagement is a ghost town compared to theirs.

- Opportunities: What external gaps can you jump on? This could be a huge content topic your main rival has completely ignored or a new customer segment they aren't targeting.

- Threats: What’s on the horizon that could cause problems? A new, disruptive competitor might be getting a lot of buzz, or perhaps a rival just launched an aggressive ad campaign targeting your core keywords.

By sorting your findings into these four boxes, you’ll get a much clearer picture of where to focus your energy for the biggest wins.

From Analysis to an Actionable Plan

Once your SWOT is filled out, patterns will begin to jump out at you. These patterns are your strategic roadmap. For instance, you might see that a competitor’s blog content is bland and they only post sporadically (their weakness), while you know your team has fantastic writers (your strength). The opportunity is clear: launch a powerhouse content marketing plan to steal their audience.

Key Takeaway: The sweet spot in any competitor analysis is finding the intersection between your competitor's weaknesses and your own strengths. That's where you have the most leverage to gain market share efficiently.

This whole process helps you build a prioritised to-do list. The trick is not to get overwhelmed and try to tackle everything at once. Look for the low-hanging fruit—the actions that will give you the biggest return for the least amount of effort.

Spotting and Filling Strategic Gaps

One of the most valuable outcomes of this whole exercise is spotting the strategic gaps in the market. Maybe you realised that none of your direct competitors offer a free trial, or their customer service gets consistently slammed in reviews. These are more than just weaknesses; they're opportunities for you to shine.

For example, if you see that a major competitor's website has a clunky, confusing checkout process that customers complain about, you’ve found a clear opening. By focusing on creating a seamless checkout experience on your own site, you're directly solving a known industry pain point. It seems simple, but this is exactly how raw data transforms into higher revenue. We actually have a full guide on how to increase conversion rates that dives deeper into this.

Common Questions About Competitor Analysis

Even with a solid plan, you're bound to run into questions once you're deep in the weeds of competitor analysis. Getting a handle on these common queries will help you sidestep the usual pitfalls and make your research genuinely useful. It’s all about building a sustainable process, not just a one-off report that gathers digital dust.

Here are some quick, practical answers to the questions I hear most often from clients.

How Often Should I Perform Competitor Analysis?

Honestly, the ideal frequency really depends on your industry. If you're in a fast-moving space like e-commerce or software, a proper deep dive every quarter is a smart rhythm to get into. This keeps you ahead of market shifts and new feature rollouts from your rivals.

For more stable industries, a bi-annual or even an annual review can be enough. The crucial thing is to never treat it as a "set it and forget it" project.

The secret is to combine deep dives with continuous, low-effort monitoring. You can set this up easily:

- Google Alerts: Create alerts for your top 3-5 competitors' brand names.

- Social Listening: Use a simple tool to track mentions and see what people are saying.

- Newsletter Subscriptions: Jump on their mailing lists. It's the easiest way to see their promotions and announcements firsthand.

This blend ensures you catch major strategic moves—like a new product launch or a big marketing push—as they happen, without needing to run a full analysis every single month.

What Is the Biggest Mistake People Make?

Hands down, the most common pitfall I see is ‘analysis paralysis’. This is what happens when you get so buried in collecting data that you never actually do anything with it. Remember, the goal isn't to know every single thing about your rivals; it's to find a handful of key insights you can realistically act on.

Another classic mistake is focusing too narrowly on direct competitors. It’s so easy to get tunnel vision and only watch the companies that look and feel just like you. But when you do that, you completely miss the emerging start-ups or indirect rivals who might be solving your customer's problem in a totally new way.

My advice is to always include at least one 'disruptor' or indirect competitor in your analysis. It forces you to think outside your immediate bubble and can reveal threats and opportunities you would have otherwise missed.

Can I Do a Meaningful Analysis on a Tight Budget?

Absolutely. While the premium tools are powerful, you can uncover a shocking amount of intelligence for free. A limited budget is no excuse for having a competitive blind spot.

Your free toolkit should include:

- Incognito Browsing: Use Google in an incognito window to see what unbiased search results for your main keywords look like.

- Social Media Profiles: Manually review their LinkedIn, X (formerly Twitter), and Instagram feeds. Look at their messaging, engagement rates, and the type of content that gets the most reaction.

- Customer Review Sites: Spend some serious time on platforms like Trustpilot or G2. Reading what customers complain about and praise gives you raw, unfiltered feedback on their real-world strengths and weaknesses.

These free methods provide a surprisingly strong foundation for understanding their brand positioning, customer sentiment, and overall marketing strategy.

Ready to turn competitive insights into a powerful growth strategy? At Amax Marketing, we specialise in data-driven SEO and marketing plans that give you a real edge. Book your free marketing audit today and let's uncover your biggest opportunities.